Renters Insurance in and around Allen Park

Renters of Allen Park, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

Your rented apartment is home. Since that is where you relax and spend time with your loved ones, it can be beneficial to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your coffee maker, craft supplies, couch, etc., choosing the right coverage can insure your precious valuables.

Renters of Allen Park, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Allen Park Choose State Farm

It's likely that your landlord's insurance only covers the structure of the apartment or townhome you're renting. So, if you want to protect your valuables - such as a tool set, a bicycle or a cooking set - renters insurance is what you're looking for. State Farm agent Dawn Pullis wants to help you examine your needs and keep your things safe.

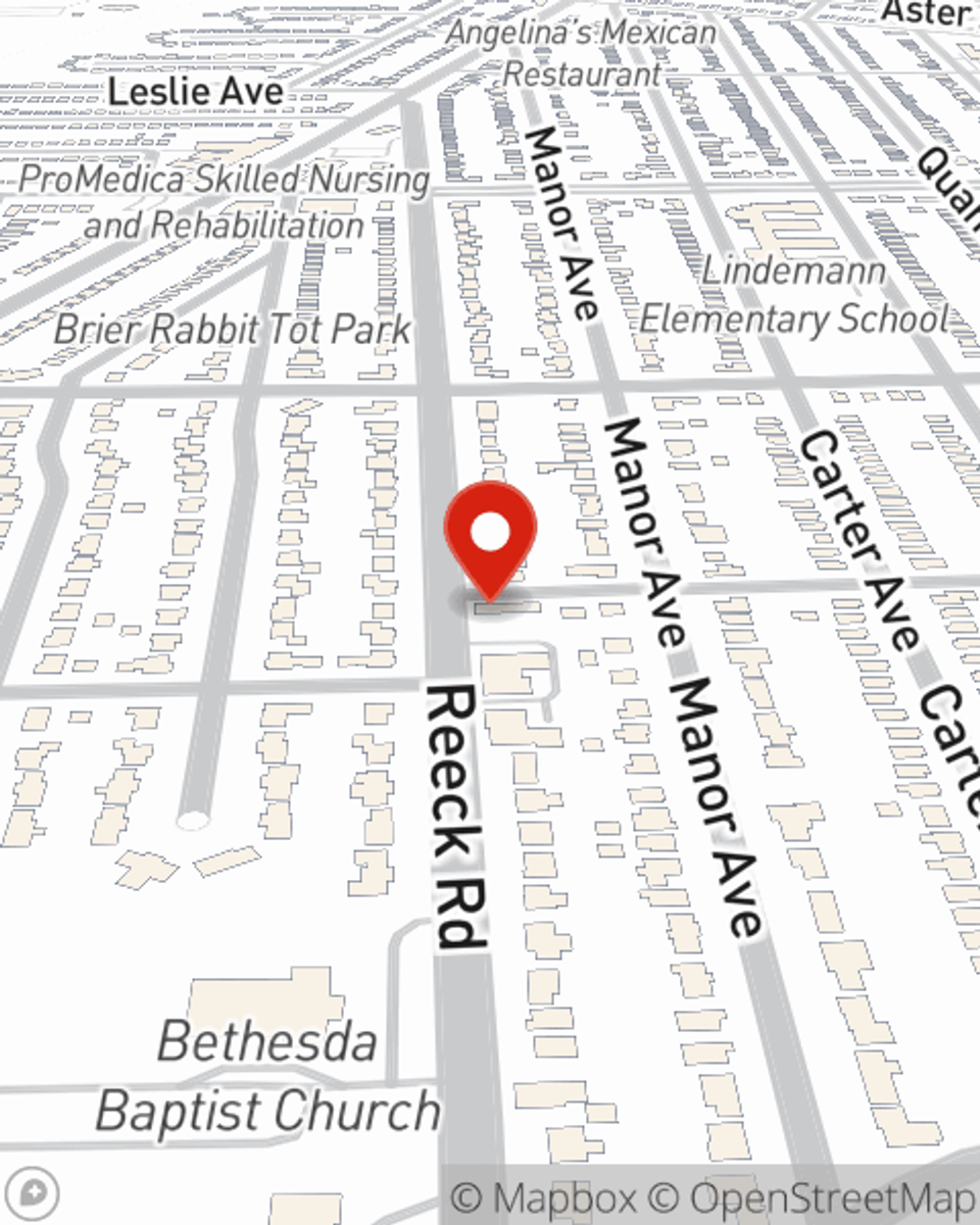

A good next step when renting a apartment in Allen Park, MI is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and learn more about how State Farm agent Dawn Pullis can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Dawn at (313) 551-4707 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Dawn Pullis

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.